Sinarmas Multifinance: Digitalizing used car financing

Sinarmas Multifinance: Digitalizing used car financing

Discover the winning strategy of how we ease the journey for buying and selling used cars.

Seize it to win it

Seize it to win it

Indonesia's used car sales are soaring post-pandemic, primarily due to health concerns and affordability. Sinarmas Multifinance (SMMF), as a financier, is trying to seize this rising trend. However, it was recently revealed that their current loan application process isn't ideal for dealers and buyers, with the manual process being the most outstanding issue.

So to become the winner in the used car financing market, SMMF is ready to build an app for used car dealers, the key influencer in recommending loan financiers to buyers.

Broken application process

Broken application process

The car-buying process has sent shivers up the buyers' spines, let alone if they decide to take out a loan.

To ease the burden, dealers usually assist with the overall loan application process. However, it's not ideal. Most of the time, dealers have difficulty determining an accurate loan quote for buyers, manual document submission, and inability to track buyers' loan application status.

These issues frustrate both dealers and buyers and also hinder SMMF's ultimate goal of winning the used car financing market.

Win the dealer, win the market

Win the dealer, win the market

The process of buying a car is a battle not yet won by both dealers and buyers. To address the problem, SMMF decides to seize the opportunity by giving the dealers a seamless platform which allows them to sell cars faster that embodies the following attributes: simplicity, speed, and transparency.

Win-win for everyone

Win-win for everyone

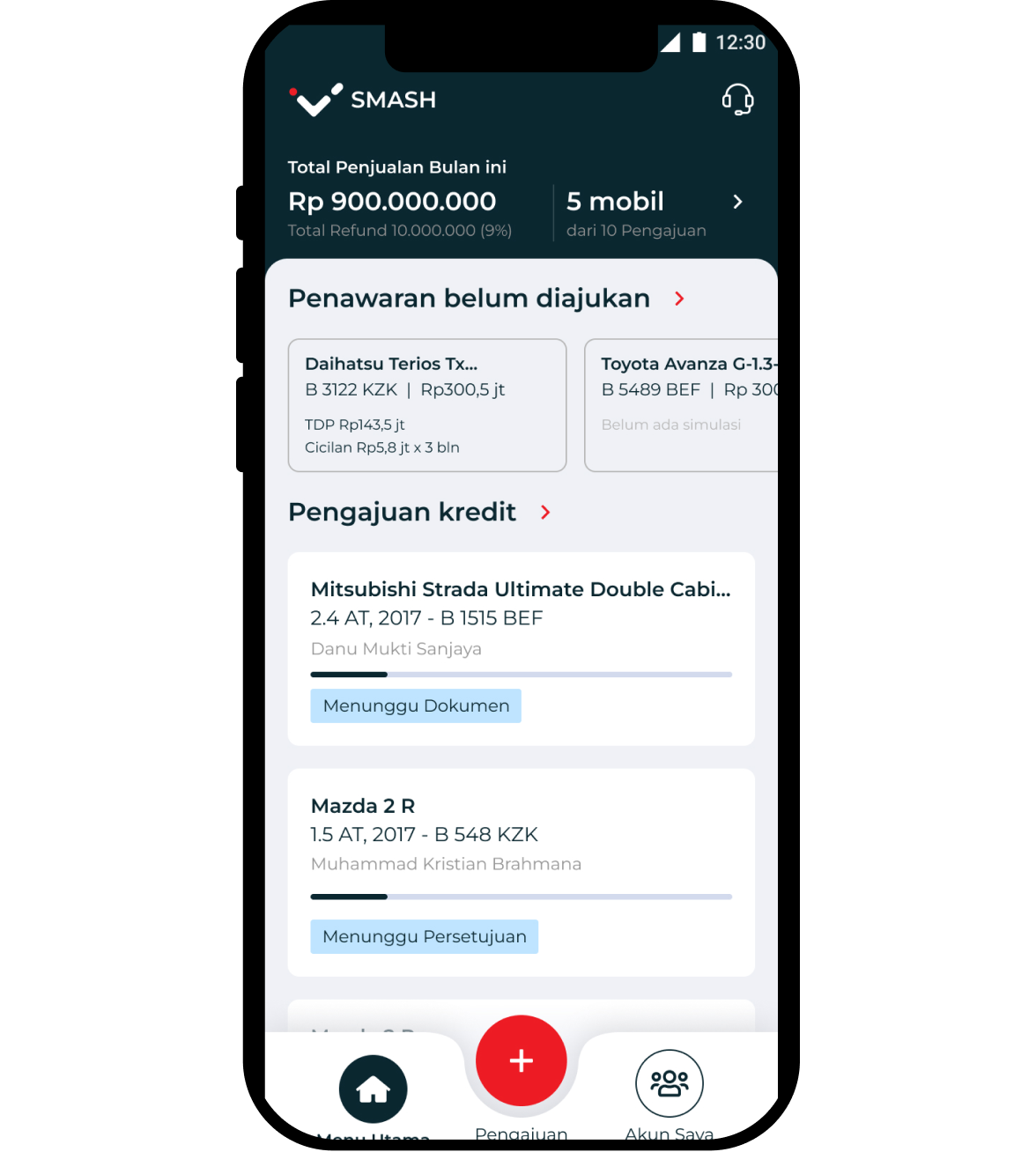

SMMF managed to alleviate dealers and buyers’ pain points through a new digital journey that’s advantageous for both parties. It allows dealers to enhance their own sales processes, whereas for buyers it provides precise loan quotes and transparency. The app will be launched some time this year, in the meantime, here are the previews:

Loan simulator

Dealers can give exact illustration and adjust prospective buyers’ down payment, loan repayment, and their tenure.

Refund adjustment

Dealers can now adjust their refund amount according to their needs.

Loan quote for buyer

Dealers can now send buyers’ exact loan quote into their SMS or WhatsApp conveniently.

Direct document upload

Dealers and buyers can now upload the required documents into the apps directly and get the application result quickly.

Trackable application status

Dealers can now track buyers’ loan application status real time.

Dealer’s dashboard

Dealers can get real-time insights on their sales performance and keep track of their incentives.